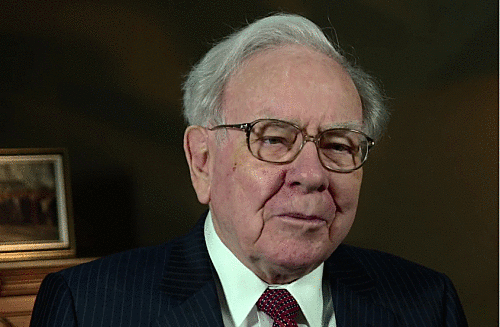

Here are some of the views on investing in gold by one of the richest men in the world, Warren Buffett.

Let me know what you think, ask me a question, or suggest something I cover in the future in the comments below!

“You could take all the gold that's ever been mined, and it would fill a cube 67 feet in each direction. For what it's worth at current gold prices, you could buy — not some — all of the farmland in the United States.

Plus, you could buy 10 Exxon Mobiles, plus have $1 trillion of walking-around money. Or you could have a big cube of metal. Which would you take? Which is going to produce more value?”

The argument Buffett uses in favor of other investments vs gold is that businesses, real estate, and other investments can actually grow a lot more than gold because they are more functional than just a type of metal.

“I have no views as to where it (gold) will be, but the one thing I can tell you is it won't do anything between now and then except look at you. Whereas, you know, Coca-Cola will be making money, and I think Wells Fargo will be making a lot of money, and there will be a lot — and it's a lot — it's a lot better to have a goose that keeps laying eggs than a goose that just sits there and eats insurance and storage and a few things like that.”

Again, Buffett compares gold to businesses. Businesses grow, create products, get more customers, etc. Gold is just a metal that sits in a vault somewhere. If you invest in good companies, they will probably return a lot more money on your investments than gold will. Buffett definitely likes the potential of companies a lot more than gold.

Related content you might also enjoy

-

Remote Technical Support Job at KeyMe November 11, 2025

Remote Technical Support Job at KeyMe November 11, 2025 -

New Remote Support Job with No Experience Required at Senture November 11, 2025

New Remote Support Job with No Experience Required at Senture November 11, 2025 -

Remote Roadside Assistance Job at Agero November 6, 2025

Remote Roadside Assistance Job at Agero November 6, 2025 -

Remote Data Entry & Support Job at Resource Innovations November 6, 2025

Remote Data Entry & Support Job at Resource Innovations November 6, 2025 -

Remote Email Support Job at Product Marketing Alliance November 6, 2025

Remote Email Support Job at Product Marketing Alliance November 6, 2025